Why Digital Payments Are the Future of Finance in the USA—this isn’t just a prediction; it’s already happening. Imagine a world where you no longer need to carry cash, worry about losing your wallet, or wait in long lines to pay bills. Sounds convenient, right? That’s the reality digital payments are creating. In 2023, over 82% of Americans used digital payment methods, and this number is only growing. From mobile wallets like Apple Pay and Google Pay to peer-to-peer platforms like Venmo, the way we handle money is changing faster than ever.

But why is this shift so significant, and how can you benefit from it? Whether you’re a tech-savvy consumer, a small business owner, or someone just curious about the future of finance, this blog post will guide you through the rise of digital payments, their undeniable advantages, and actionable steps to make the most of this financial revolution. By the end, you’ll understand why digital payments are not just a trend but the foundation of a smarter, faster, and more secure financial future.

Let’s dive in and explore how you can stay ahead in this digital-first world.

Table of Contents

The Rise of Digital Payments in the USA

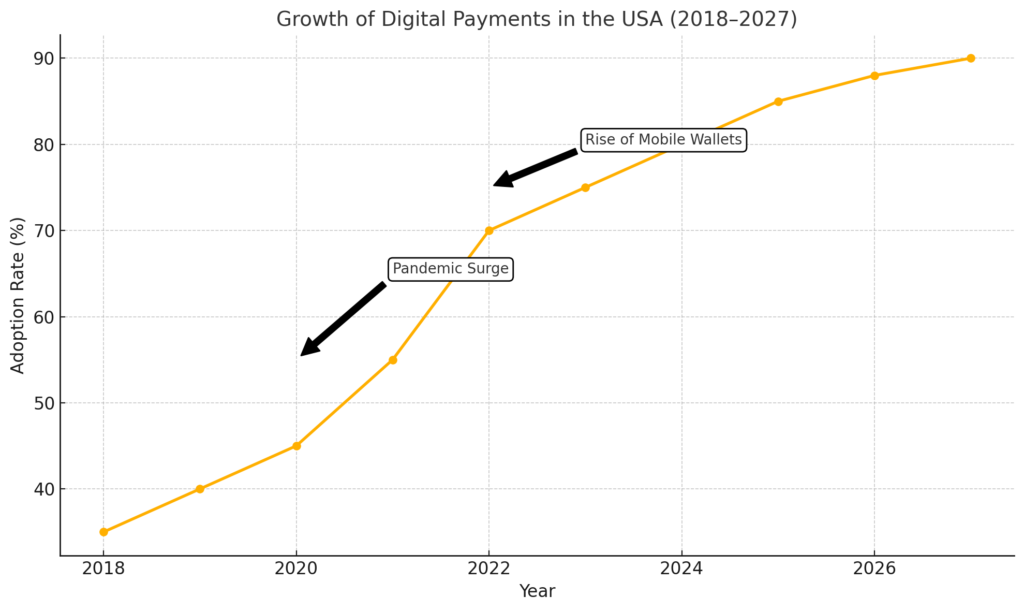

The adoption of digital payments in the USA has skyrocketed in recent years. With the rise of smartphones, e-commerce, and fintech innovations, consumers are increasingly ditching cash and checks for faster, more secure payment methods. According to a 2023 report by Statista, the total transaction value in the digital payments market is projected to reach $2.5 trillion by 2027.

Key Drivers Behind the Digital Payment Boom

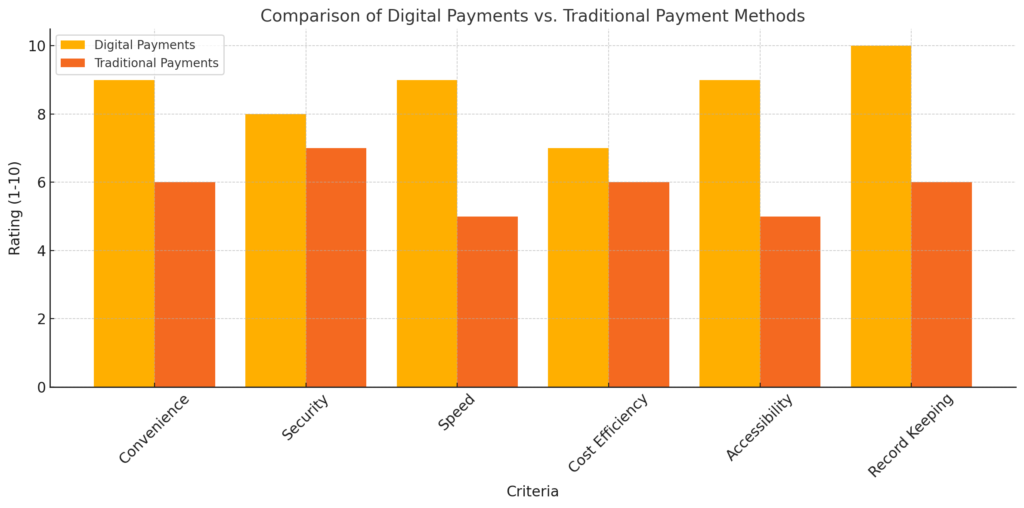

- Convenience: Digital payments allow users to make transactions anytime, anywhere.

- Security: Advanced encryption and fraud detection systems make digital payments safer than traditional methods.

- Pandemic Influence: COVID-19 accelerated the shift to contactless payments, as consumers sought safer ways to pay.

Benefits of Digital Payments for Consumers and Businesses

Digital payments offer numerous advantages for both consumers and businesses.

For Consumers

- Speed: Transactions are completed in seconds.

- Rewards: Many digital payment platforms offer cashback and loyalty programs.

- Budgeting Tools: Apps like PayPal and Venmo help users track spending.

For Businesses

- Lower Costs: Digital payments reduce the need for cash handling and manual processing.

- Increased Sales: Offering multiple payment options can boost customer satisfaction and sales.

- Global Reach: Businesses can accept payments from customers worldwide.

How to Benefit from the Digital Payment Revolution

Now that you understand why digital payments are the future, here’s how you can benefit from this trend.

Choose the Right Digital Payment Platform

- Research platforms like PayPal, Apple Pay, Google Pay, and Venmo to find one that suits your needs.

- Look for low fees, strong security features, and user-friendly interfaces.

Leverage Digital Payment Tools for Financial Growth

- Use budgeting apps to track expenses and save money.

- Invest in cryptocurrencies or digital assets if you’re comfortable with risk.

Stay Informed About Emerging Trends

- Keep an eye on developments like Central Bank Digital Currencies (CBDCs) and blockchain technology.

Challenges and Solutions in the Digital Payment Landscape

While digital payments offer many benefits, they also come with challenges.

Security Concerns

- Solution: Use two-factor authentication and strong passwords to protect your accounts.

Digital Divide

- Solution: Advocate for better internet access and digital literacy programs in underserved communities.

Regulatory Issues

- Solution: Stay updated on local and federal regulations to ensure compliance.

The Future of Digital Payments in the USA

The future of digital payments in the USA is bright. Innovations like AI-driven fraud detection, biometric authentication, and decentralized finance (DeFi) are set to redefine the industry. By 2030, experts predict that cash will account for less than 10% of all transactions in the USA.

Conclusion: Why Digital Payments Are the Future of Finance in the USA (And How to Benefit)

The shift toward digital payments is not just a trend—it’s a fundamental transformation in how we handle money. From the convenience of mobile wallets to the security of encrypted transactions, digital payments are reshaping the financial landscape in the USA. With over 82% of Americans already using digital payment methods and the market projected to hit $2.5 trillion by 2027, it’s clear that this is the future of finance.

By embracing digital payments, you can enjoy faster transactions, better financial tracking, and access to innovative tools that simplify your life. Whether you’re a consumer looking for convenience or a business aiming to expand your reach, the benefits are undeniable. However, staying informed and proactive is key. Keep an eye on emerging trends like blockchain technology and Central Bank Digital Currencies (CBDCs) to stay ahead of the curve.

Now is the time to take action. Explore trusted platforms like PayPal, Apple Pay, or Google Pay, and start integrating digital payments into your daily life. If you’re a business owner, consider how offering multiple payment options can enhance customer satisfaction and drive growth.

Call-to-Action (CTA):

What’s your experience with digital payments? Have you noticed how they’ve changed the way you manage money? Share your thoughts in the comments below! If you found this article helpful, don’t forget to share it with your network and subscribe to our newsletter for more insights on the future of finance.

For further reading, check out this comprehensive report by the Federal Reserve on the rise of digital payments: Federal Reserve Digital Payments Report.

Remember, the future of finance is digital—don’t get left behind. Start your journey today and unlock the full potential of digital payments in the USA! [TechGeniuxio.com]

-

Best Budget Smartphones Under $500 in the USA (2026 Buyer’s Guide)

Sharing articles Facebook Twitter Pinterest LinkedIn Best budget smartphones under $500 in the USA have reached a level in 2026 where buyers no longer need to compromise on performance, camera quality, or long-term software support. What was once considered “mid-range” is now powerful enough for everyday users, content creators, students, and even light mobile gamers…