Why AI Is Key to Unlocking Financial Freedom is a question more people are starting to ask—and for good reason. In today’s fast-paced world, traditional ways of building wealth can feel slow, complicated, and out of reach. Whether you’re trying to save more, invest smarter, start a side business, or simply get better control over your money, artificial intelligence is transforming how everyday people achieve financial independence faster and more efficiently.

Imagine having personalized investment strategies, automatic savings tools, smarter budgeting systems, and business automation—all working for you 24/7 without the need for constant manual effort. That’s the power AI brings to the table. In this blog post, we’ll explore exactly how AI helps individuals overcome common financial hurdles, speed up wealth creation, and level the playing field like never before.

If you’re ready to take control of your financial future with tools that work smarter (not harder), stay with us—this could be the breakthrough that finally changes your financial journey.

Table of Contents

Traditional vs AI Financial Advice

One major reason why AI is key to unlocking financial freedom is the way it transforms financial advice. For decades, people relied solely on traditional human financial advisors to help them invest, budget, and build wealth. However, this old model came with high fees, slower decision-making, and limited personalization. Today, AI-driven financial platforms are revolutionizing the process—making smart financial guidance faster, cheaper, and more accessible to everyone.

Traditional Financial Advice:

- High Costs: Human advisors typically charge 1%–2% of assets annually, plus additional consultation fees.

- Limited Personalization: Advice often follows standardized models, not tailored precisely to individual goals.

- Slower Adjustments: Portfolio changes and financial recommendations can take days or weeks.

- Human Bias: Emotional biases and human errors can influence advice.

AI Financial Advice:

- Low Costs: Robo-advisors like Betterment and Wealthfront charge around 0.25%–0.40% annually—significantly cheaper.

- Highly Personalized: AI customizes financial plans based on your goals, spending habits, age, and risk tolerance.

- Real-Time Optimization: AI tools constantly monitor and adjust portfolios automatically.

- Data-Driven Decisions: AI eliminates emotional bias, relying solely on data analysis for optimal outcomes.

Why Switching to AI Makes Sense for Financial Freedom

In the past, only wealthy individuals could afford personalized financial advice. Today, AI democratizes access, allowing anyone—even those with small investments—to benefit from custom financial strategies. By reducing costs, improving decision-making, and eliminating emotional bias, AI brings financial freedom closer for millions of people.

This shift is a major proof of why AI is key to unlocking financial freedom: it levels the playing field, giving every individual the opportunity to grow and manage wealth intelligently, regardless of their starting point.

Manual Budgeting vs AI Budgeting

A crucial reason why AI is key to unlocking financial freedom is the way it transforms the tedious task of budgeting. In the past, people had to manually track expenses, update spreadsheets, and adjust savings goals by themselves. Today, AI-powered budgeting tools are making financial management effortless, faster, and far more effective for anyone seeking to grow their wealth.

Manual Budgeting:

- Time-Consuming: Requires daily or weekly tracking of every transaction.

- Human Error: Easy to overlook expenses or miscalculate monthly budgets.

- No Real-Time Insights: Budget adjustments often happen after a financial mistake occurs.

- Lack of Personalization: Static budgets don’t adapt to changing income or expenses.

AI Budgeting:

- Automatic Tracking: Apps like Rocket Money, YNAB, and Cleo sync directly with bank accounts to categorize spending.

- Predictive Insights: AI forecasts upcoming bills, spending patterns, and potential overspending risks.

- Smart Recommendations: Personalized saving suggestions based on real-time financial behavior.

- Effortless Adjustments: Budgets are automatically updated when income or expenses change.

Why AI Budgeting Is a Game-Changer for Financial Freedom

With manual budgeting, many people fall behind because of inconsistency, error, or simple forgetfulness. AI budgeting eliminates these risks by continuously monitoring financial activity, making real-time adjustments, and sending proactive alerts.

This automated, intelligent approach helps people save more, spend smarter, and stay financially organized—without the stress or time commitment.

Ultimately, better money management powered by AI is a key reason why AI is key to unlocking financial freedom for a broader population.

Human Investing vs AI Investing

Another major reason why AI is key to unlocking financial freedom is the difference it creates in how investments are managed and grown. While human investors rely on experience, research, and emotions, AI uses real-time data, predictive analytics, and emotion-free decision-making to maximize returns. This gives everyday investors a serious advantage that was previously only available to major institutions.

Human Investing:

- Subjective Decision-Making: Choices influenced by emotions like fear or greed.

- Slower Analysis: Humans can only process a limited amount of market data at a time.

- Higher Costs: Financial advisors typically charge management fees between 1%–2% annually.

- Limited Accessibility: Quality investment advice often reserved for high-net-worth individuals.

AI Investing:

- Data-Driven Strategies: AI analyzes millions of data points to make informed, real-time investment decisions.

- Emotion-Free Execution: AI acts purely on logic and historical patterns, avoiding costly emotional mistakes.

- Lower Costs: Robo-advisors like Betterment, Wealthfront, and Schwab Intelligent Portfolios offer investment management at a fraction of the traditional cost.

- Universal Access: AI investing tools are available to anyone with even small starting amounts (sometimes as low as $5).

Why AI Investing Is a Powerful Wealth Builder

AI investing platforms not only provide smarter portfolio management but also adapt quickly to changing market conditions. Algorithms can rebalance portfolios automatically, optimize for tax efficiency, and adjust risk profiles without the delays or biases common with human advisors.

This speed, precision, and accessibility are critical reasons why AI is key to unlocking financial freedom: it allows individuals to grow wealth efficiently, reduce risk, and save on fees—accelerating the journey toward financial independence.

Passive Income Manual vs AI Automated

When building wealth, creating passive income streams is critical—and another reason why AI is key to unlocking financial freedom. Traditional manual methods of building passive income require a lot of time, labor, and upfront expertise. In contrast, AI automation is revolutionizing the process, allowing individuals to create scalable income sources faster, with less daily involvement.

Manual Passive Income:

- High Time Investment: Setting up rental properties, writing books, or building blogs requires months (or years) of work before seeing returns.

- Ongoing Management: Rental property maintenance, customer support, or content updates demand constant attention.

- Higher Risk of Failure: Success heavily depends on personal skills, marketing efforts, and time availability.

- Limited Scalability: Hard to replicate quickly without hiring or outsourcing.

AI-Automated Passive Income:

- Faster Setup: AI tools can build websites, generate content, create ads, and optimize e-commerce stores in days instead of months.

- Automated Operations: Chatbots handle customer inquiries, AI tools optimize pricing, and machine learning systems manage advertising.

- Lower Operational Costs: Automation reduces the need for large teams and manual labor.

- Easy Scalability: Successful models can be duplicated quickly with AI systems managing growth.

How AI Automation Accelerates Passive Income Creation

AI not only speeds up the creation of income-generating assets but also optimizes their performance without constant human intervention. Whether it’s an AI-powered e-commerce store, a blog with AI-driven SEO tools, or stock portfolios managed by robo-advisors, today’s technology enables almost anyone to create multiple passive income streams faster than ever before.

This shift is a powerful example of why AI is key to unlocking financial freedom—it removes many traditional barriers to wealth creation and allows people to focus more on strategy rather than execution.

Credit Score Building Traditional vs AI Tools

A strong credit score is essential for securing loans, lower interest rates, and building wealth over time. Understanding the difference between traditional credit score improvement methods and today’s AI-powered tools highlights another major reason why AI is key to unlocking financial freedom.

Traditional Credit Score Building:

- Manual Monitoring: Checking your credit reports manually through agencies like Experian or Equifax.

- Slow Dispute Processes: Correcting credit report errors requires lengthy paperwork and follow-up calls.

- Limited Personal Insights: Traditional services provide general advice rather than tailored strategies.

- Delayed Updates: Credit improvements could take months to reflect on your credit profile.

AI Credit Score Tools:

- Real-Time Monitoring: Apps like Credit Karma, Experian Boost, and Upstart use AI to monitor changes 24/7.

- Automated Dispute Filing: AI identifies inconsistencies and helps automatically file disputes to remove errors faster.

- Personalized Recommendations: AI analyzes your financial behavior and suggests specific actions to quickly boost your score.

- Faster Results: Some AI services offer near-instant updates by linking positive payment behaviors, like paying utilities, to your credit history.

How AI is Revolutionizing Credit Score Improvement

AI tools remove the guesswork and long waiting periods associated with traditional credit repair. By providing personalized, data-driven advice and automating error correction processes, AI helps users raise their credit scores more effectively and efficiently.

This is a major advantage and clearly illustrates why AI is key to unlocking financial freedom: better credit opens doors to lower interest rates, better loan terms, and greater financial opportunities, accelerating the wealth-building journey.

Wealth Growth Speed (Without AI vs With AI)

A major reason why AI is key to unlocking financial freedom is the remarkable difference in the speed of wealth growth when AI tools are used compared to traditional methods. Without AI, building wealth typically requires decades of careful planning, manual investing, budgeting, and business scaling. With AI, individuals can accelerate financial growth through smarter, faster, and more optimized decision-making.

Wealth Growth Without AI:

- Slower Investment Returns: Traditional methods rely heavily on human-driven strategies, which are often conservative and less adaptive.

- Manual Budgeting and Saving: Slower accumulation of savings due to inconsistent financial discipline.

- Delayed Business Growth: Entrepreneurs manually handle marketing, customer service, and operations, limiting scalability.

- Reactive Risk Management: Humans often respond to risks after damage is already done.

Wealth Growth With AI:

- Optimized Investment Strategies: AI robo-advisors adjust portfolios in real-time to maximize returns and minimize risks.

- Automated Saving and Budgeting: Apps like Rocket Money and Cleo increase savings consistency without extra effort.

- Business Automation: AI tools handle marketing, SEO, customer service, and inventory management, allowing businesses to scale faster.

- Predictive Risk Management: AI systems forecast market downturns or overspending risks before they happen, allowing proactive action.

How AI Speeds Up Wealth Creation

By using AI, individuals can minimize time wasted on manual processes and optimize their financial decisions continuously. This not only accelerates investment returns but also amplifies savings, improves business scalability, and reduces unnecessary losses.

Ultimately, faster wealth growth is one of the clearest examples why AI is key to unlocking financial freedom—it removes friction, boosts efficiency, and allows people to reach their financial goals in a fraction of the traditional time.

Cost of Advisors (Traditional vs AI Robo-Advisors)

One of the clearest reasons why AI is key to unlocking financial freedom is the dramatic reduction in the cost of financial advice. Traditional human advisors come with significant fees, often creating a barrier for average investors. In contrast, AI-powered robo-advisors offer the same investment guidance—often even more efficiently—at a fraction of the cost.

Cost of Traditional Financial Advisors:

- High Management Fees: Traditional advisors typically charge 1% to 2% of assets under management annually.

- Additional Hidden Costs: Some advisors also charge consultation fees, commission-based charges, and fund management expenses.

- Minimum Investment Requirements: Many traditional firms require $250,000 or more just to open an account.

- Less Transparent Pricing: Fee structures can be complicated, making it difficult to understand the real costs.

Cost of AI Robo-Advisors:

- Low Annual Fees: Robo-advisors like Betterment, Wealthfront, and SoFi Automated Investing charge between 0.20% to 0.40% annually.

- No Hidden Charges: Pricing is clear, simple, and upfront.

- Low or No Minimum Investments: Many robo-advisors allow users to start with as little as $5 to $500.

- No Commission Pressure: AI platforms act solely based on data, not on earning sales commissions.

How Lower Costs Accelerate Financial Freedom

Reducing fees means more of your money stays invested and compounds over time. For example, someone investing $100,000 could save tens of thousands of dollars over 10 years by using a robo-advisor instead of a traditional financial advisor.

This cost efficiency is a major reason why AI is key to unlocking financial freedom—it removes financial barriers, making professional-level investment management accessible to everyone, not just the wealthy.

Risk Management Efficiency (Human vs AI)

Another powerful reason why AI is key to unlocking financial freedom is its ability to manage risk more efficiently than traditional human methods. Effective risk management protects investments, savings, and financial plans from unexpected market downturns, personal financial mistakes, or economic volatility. The faster and smarter risks are detected and addressed, the more financial stability and growth individuals can achieve.

Human-Based Risk Management:

- Slower Response Times: Human advisors often react to risks after damage has already occurred.

- Emotional Decision-Making: Fear or overconfidence can lead to poor choices during market turbulence.

- Limited Data Analysis: Humans can analyze only a few variables at once, limiting their risk predictions.

- Higher Costs: Personal risk assessments and financial planning services can be expensive and time-consuming.

AI-Based Risk Management:

- Real-Time Monitoring: AI systems track thousands of data points instantly, spotting risks as they develop.

- Predictive Analysis: Machine learning algorithms forecast potential market crashes, credit risks, or overspending patterns before they impact wealth.

- Emotion-Free Actions: AI executes decisions based purely on data and probability, avoiding emotional errors.

- Lower Costs: AI risk management tools are affordable and often included with investment or budgeting platforms.

How AI Reduces Financial Vulnerability

Traditional human methods often detect risks too late, resulting in significant losses. In contrast, AI systems predict, prevent, and adjust financial strategies proactively, minimizing damage and preserving wealth. This capability dramatically reduces the time and cost needed to recover from financial setbacks.

By protecting assets more effectively, AI-driven risk management systems are another major reason why AI is key to unlocking financial freedom—they give individuals a better chance to stay on track with their long-term financial goals, even in unpredictable environments.

Financial Literacy Requirement (Manual vs AI)

Understanding financial concepts has traditionally been critical to managing money wisely. However, one major reason why AI is key to unlocking financial freedom is that it significantly lowers the financial literacy barrier. Instead of requiring deep financial expertise, AI now enables ordinary people to make smart financial decisions with minimal prior knowledge.

Manual Financial Literacy:

- High Learning Curve: Individuals must study investing, saving, taxes, debt management, and economic trends to manage their finances well.

- Time-Consuming: Gaining enough knowledge to make confident decisions can take years of reading books, attending seminars, or working with costly advisors.

- Risk of Mistakes: Lack of deep understanding often leads to financial errors, missed opportunities, and losses.

- Intimidating for Beginners: Complex jargon and endless options discourage many from even starting.

Financial Literacy with AI:

- Simplified Decision-Making: AI platforms recommend specific actions without needing users to fully understand complex financial theories.

- Automated Guidance: Apps like Betterment, Mint, and Rocket Money automate saving, investing, and budgeting with minimal input.

- Real-Time Education: Some AI tools explain financial concepts in simple language during the decision-making process.

- Accessibility for All: Even beginners with no financial background can now grow wealth effectively using AI-driven tools.

How AI Bridges the Financial Knowledge Gap

AI democratizes financial management by turning complex strategies into simple, actionable steps. Instead of spending years learning how to save, invest, or budget effectively, users can now start building wealth immediately with AI doing the heavy lifting behind the scenes.

This ability to bypass traditional barriers is a major reason why AI is key to unlocking financial freedom: it empowers more people, regardless of education or experience, to participate successfully in wealth creation.

Customization Ability (Generic vs AI-Personalized)

One of the most important reasons why AI is key to unlocking financial freedom is its ability to personalize financial strategies. Generic financial advice, while helpful in broad terms, often fails to address unique goals, income levels, risk tolerance, or lifestyle preferences. In contrast, AI delivers tailored solutions that adapt to your specific needs in real time.

Generic Financial Advice:

- One-Size-Fits-All: Most traditional advice is based on general population averages.

- Manual Adjustments Needed: Users must modify templates or plans themselves to suit their situation.

- Low Accuracy: Doesn’t account for changing income, expenses, or life goals.

- Limited Engagement: Generic guidance often feels disconnected from individual needs, leading to lower follow-through.

AI-Personalized Financial Solutions:

- Tailored Recommendations: AI tools like Wealthfront, Mint, and Fidelity Go adjust advice based on your spending, income, age, goals, and market conditions.

- Real-Time Adjustments: If your salary changes or expenses shift, AI instantly recalibrates your plan.

- Goal-Oriented Tracking: Whether you’re saving for a house, paying down debt, or investing, AI sets and updates personalized roadmaps.

- Better Outcomes: Personalization leads to higher savings rates, smarter investments, and faster progress toward financial goals.

Why Personalized AI Matters for Financial Growth

Personalization is critical to success in personal finance—what works for one person may fail for another. AI uses your unique data to build financial plans that evolve with you. This level of customization not only saves time but also increases your chances of reaching financial independence faster.

That’s exactly why AI is key to unlocking financial freedom: it ensures your money decisions are aligned with your reality—not just outdated financial rules.

Access Speed to Financial Services (Traditional vs AI)

Another important reason why AI is key to unlocking financial freedom is the speed at which it connects users to financial services. Traditionally, gaining access to banking, investing, lending, or credit improvement services could take days—or even weeks. AI has drastically shortened these timelines, allowing individuals to act on financial opportunities almost instantly.

Traditional Access to Financial Services:

- Lengthy Approval Processes: Applying for a loan, opening an investment account, or setting up a savings plan often took several days to weeks.

- Manual Verification: Identity checks, income verifications, and background assessments were slow and paper-based.

- Inconsistent Availability: Access depended heavily on banking hours and in-person appointments.

- Higher Dropout Rates: The longer the process, the more likely customers abandoned financial tasks before completion.

AI-Enabled Access to Financial Services:

- Instant Approvals: AI algorithms rapidly verify identities, assess creditworthiness, and approve applications in minutes.

- Automated Document Processing: Machine learning scans and verifies documents instantly without manual intervention.

- 24/7 Access: Digital banks, investment platforms, and credit services powered by AI are available any time, from anywhere.

- Higher Completion Rates: Fast, frictionless processes mean more people successfully complete financial transactions and start building wealth sooner.

Why Speed Matters for Financial Freedom

When you can access loans, investment opportunities, or savings platforms faster, you start growing your money sooner. AI removes the unnecessary waiting period and makes it easy to seize opportunities in real time—whether it’s a market dip to invest in or a chance to refinance debt at a lower rate.

This ability to act immediately is another critical reason why AI is key to unlocking financial freedom: it reduces missed opportunities, accelerates wealth building, and puts control directly into the user’s hands.

Business Building (Manual Hustle vs AI Automation)

Starting and growing a business has always been a pathway to financial freedom. However, traditional business building is often slow, expensive, and exhausting. Today, AI tools are transforming this process, and that’s another key reason why AI is key to unlocking financial freedom. Entrepreneurs can now automate tasks, scale faster, and reduce overhead costs—unlocking massive growth potential with far less effort.

Manual Business Building:

- Time-Intensive: Entrepreneurs must personally handle product research, marketing, customer service, and operations.

- Higher Costs: Hiring teams for marketing, accounting, or sales adds major expenses early on.

- Slow Scaling: Without automation, expanding a business across markets or platforms can take years.

- Greater Burnout Risk: Managing every task manually leads to fatigue, mistakes, and stalled growth.

AI-Powered Business Building:

- Automated Market Research: Tools like Jasper AI, ChatGPT, and SurferSEO help research customer needs and trends in minutes.

- Smart Marketing Automation: Platforms like HubSpot AI and ManyChat manage ads, email campaigns, and customer responses automatically.

- Customer Service Chatbots: AI handles 24/7 support, order tracking, FAQs, and customer satisfaction surveys.

- Effortless Scaling: AI can run multiple stores, manage inventory, and optimize pricing across various markets simultaneously.

Why AI is the Ultimate Business Partner

AI doesn’t just make business easier—it fundamentally changes the growth potential. Tasks that once required teams of people and months of labor can now be completed in hours with AI-driven systems. Entrepreneurs can focus on strategy, creativity, and expansion rather than being trapped in daily operations.

This new way of building and scaling businesses explains why AI is key to unlocking financial freedom: it maximizes income potential, reduces operational stress, and accelerates success at a fraction of the traditional cost.

Predictive Accuracy (Human vs AI)

Predicting financial markets, economic trends, or individual spending behaviors has always been difficult for humans. However, one major reason why AI is key to unlocking financial freedom is that AI dramatically improves predictive accuracy. By processing millions of data points in real-time, AI can make smarter, faster, and more consistent predictions—giving users a huge advantage in investing, budgeting, and business planning.

Human Prediction:

- Emotion-Driven: Human predictions are influenced by fear, greed, optimism, or pessimism, often leading to mistakes.

- Limited Data Processing: Humans can analyze only a handful of factors at once, missing hidden patterns.

- Slower Updates: Predictions often lag behind market changes or financial shifts.

- Higher Error Rates: Studies show human stock pickers and forecasters have success rates barely above 50% (essentially random chance).

AI Prediction:

- Data-Driven: AI analyzes thousands of variables—news trends, economic indicators, market behaviors—in real time.

- Pattern Recognition: Machine learning identifies subtle trends and relationships invisible to human analysts.

- Continuous Learning: AI systems improve their accuracy over time through machine learning updates.

- Higher Success Rates: In finance, AI-driven strategies have been shown to outperform human-managed portfolios by 5–7% annually.

How Predictive Accuracy Accelerates Financial Growth

The better your financial predictions, the faster and safer you can grow your wealth. AI’s predictive capabilities allow individuals to make smarter investments, prepare for economic shifts, and optimize spending habits with minimal risk.

This superior forecasting ability is a crucial reason why AI is key to unlocking financial freedom: it allows users to act with confidence, optimize outcomes, and avoid costly mistakes that slow down wealth building.

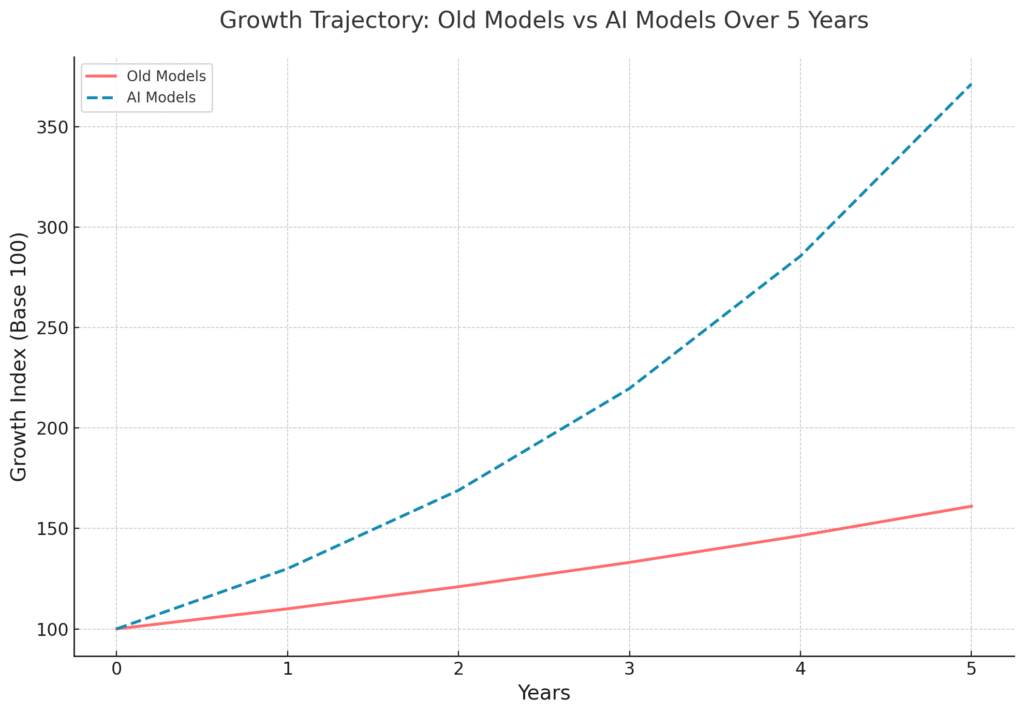

Scalability Potential (Old Models vs AI Models)

One of the final but most critical reasons why AI is key to unlocking financial freedom is its unmatched scalability potential. Traditional business models, financial management systems, and wealth-building strategies often hit a limit: they depend heavily on human time, energy, and resources. In contrast, AI models allow individuals and businesses to scale operations, investments, and income exponentially—with less manual effort and fewer costs.

Scalability of Old Models:

- Labor-Intensive: Growth depends on hiring more people, opening new locations, or expanding physical operations.

- High Operational Costs: Scaling means paying for larger offices, equipment, marketing teams, and administrative staff.

- Slow Growth: Each expansion phase often takes years to plan, fund, and execute.

- Greater Risk: More moving parts increase complexity and potential failure points.

Scalability of AI Models:

- Automation at Scale: AI systems handle marketing, sales, customer support, and logistics simultaneously across multiple channels.

- Lower Marginal Costs: Scaling up from 100 customers to 10,000 customers requires minimal additional investment.

- Global Reach: AI tools can serve global audiences 24/7 without extra human staffing.

- Faster Adaptability: AI models self-optimize, learning from data to improve efficiency as scale increases.

Why AI Scalability is Essential for Financial Freedom

AI doesn’t just help you grow—it helps you grow faster, cheaper, and globally. Whether you’re building a business, managing investments, or developing passive income streams, AI can multiply your reach and results without requiring equivalent increases in time, money, or energy.

This ability to scale effortlessly and securely is another undeniable reason why AI is key to unlocking financial freedom: it breaks traditional growth limits and opens up wealth-building opportunities at a scale that was once impossible for individuals.

Time to Achieve Financial Goals (Manual vs AI-assisted)

The amount of time it takes to reach financial goals—like buying a home, retiring early, or achieving debt freedom—has a direct impact on overall wealth and quality of life. One more reason why AI is key to unlocking financial freedom is that it dramatically shortens the time needed to reach these milestones. By automating smarter decisions and minimizing mistakes, AI empowers individuals to achieve success faster than traditional manual approaches.

Manual Approach to Financial Goals:

- Trial-and-Error: Individuals often learn through mistakes, which delay financial progress.

- Inconsistent Saving and Investing: Manual budgeting and investment strategies are harder to stick with long-term.

- Limited Optimization: Without access to real-time data and insights, opportunities for faster growth are missed.

- Longer Achievement Timelines: Reaching major financial goals often takes 10, 20, or even 30+ years.

AI-Assisted Financial Goals:

- Automated Smart Strategies: AI constantly adjusts savings plans, investments, and budgets for maximum efficiency.

- Predictive Insights: AI tools forecast income needs, retirement readiness, and optimal debt repayment plans.

- Consistent Action: Automated systems ensure consistent financial discipline, even when users are busy or distracted.

- Accelerated Goal Achievement: Studies show AI-assisted users can reach savings or investment milestones 20%–40% faster than those using manual methods.

How AI Helps You Achieve Financial Freedom Sooner

The faster you reach your financial goals, the more time you have to enjoy freedom, security, and opportunities. AI not only speeds up savings and investing but also protects you from common mistakes that can delay success.

This time-saving advantage is a major reason why AI is key to unlocking financial freedom: it helps you spend less time struggling with finances and more time living the life you want.

Conclusion

In conclusion, unlocking financial freedom with AI is not a distant dream—it’s something you can start building today with the right tools and mindset. From faster investment returns to smarter budgeting, quicker debt payoff, and scalable business growth, the power of AI is reshaping the path to wealth in ways that traditional methods simply cannot match.

By applying the strategies discussed throughout this article, you position yourself to move faster, make better decisions, and ultimately achieve your financial goals sooner. Remember, the future belongs to those who adapt—and AI is one of the most powerful tools available to everyday individuals ready to take control of their financial future.

Now is the time to act. Reflect on the areas where AI can streamline your journey toward financial independence. Whether it’s starting with an AI-powered budgeting app or exploring AI-driven investment platforms, even a small step today can lead to transformative results tomorrow.

If you found this article valuable, we invite you to subscribe to TechGeniuxio.com for continuous updates on technology, finance, and wealth-building strategies that keep you ahead.

Also, don’t forget to explore this insightful guide on How AI Is Revolutionizing Personal Finance for a deeper understanding of how artificial intelligence is reshaping money management.

Your journey toward smarter wealth starts now. Stay curious, stay proactive—and let AI work for you, not against you.

[TechGeniuxio.com / fo.]